Dubai’s special economic zone, the Dubai International Financial Centre (DIFC), has released a new report that explores the opportunities related to fintech in the Middle East and African (MEA) region. The report provides recommendations and guidance for fintech firms looking to capitalize on the growth of fintech in region.

The whitepaper, draws on the experience of industry participants. It was produced in collaboration with LendIt Fintech, the organizer of one of the world’s largest fintech event series, and was launched at the LendIt Fintech USA 2019 conference which took place in San Francisco on April 8 and 9, 2019.

MEA’s fintech opportunity

According to the report, the Middle East and North Africa (MENA) region’s fintech market is still in its early stage but filled with potential for rapid growth.

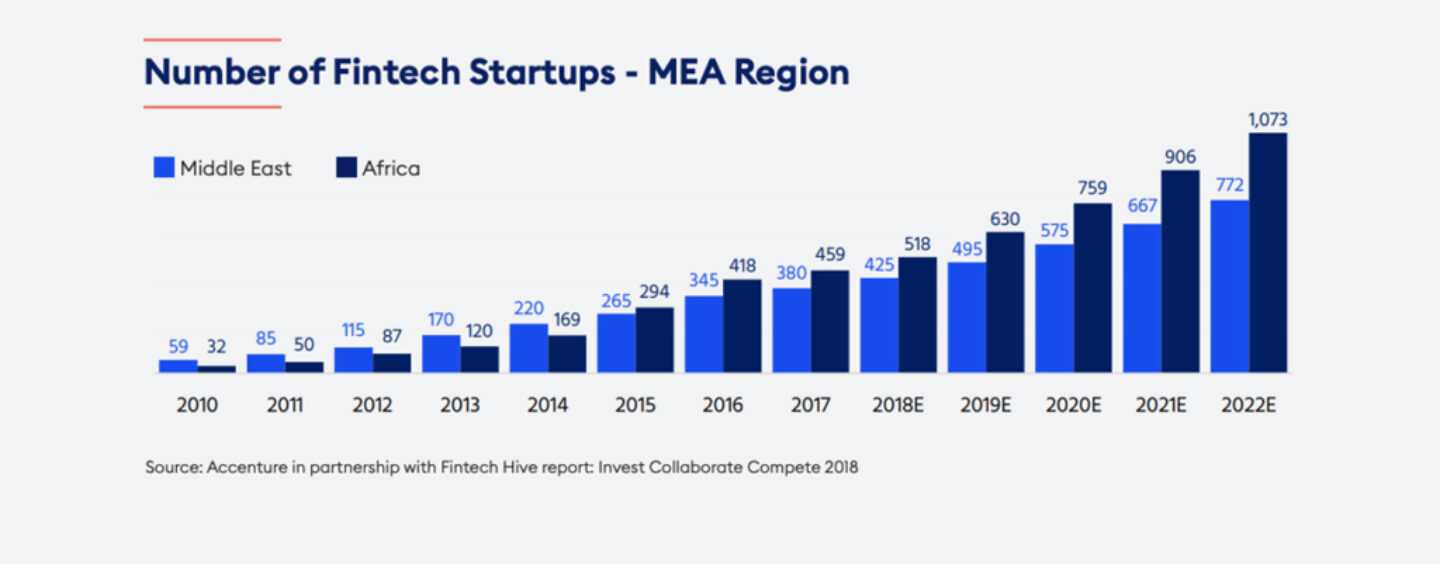

Fintech companies currently earn 3% of the region’s overall financial services revenue, a figure expected to reach 8% by 2020, and the number of fintech companies in MENA is set to rise to 1,845 by 2022, from 559 fintech companies in 2015.

Research company MENA Research Partners estimates that the fintech market in MENA was estimated at US$2 billion in 2018 and is expected to reach US$2.5 billion by 2022.

Number of Fintech Startups – MEA Region, A Roadmap for Fintech Firms Entering the Fast-Growing Emerging Markets, April 2019

The region offers many opportunities for fintech startups to collaborate and experiment with innovation solutions. Financial regulators are creating sandbox environments in which startups can test their products, accelerators are helping drive the growth of companies in the field, and banks are open to collaborate with fintechs, the report says.

According to Arif Amiri, CEO of DIFC Authority, despite the notable growth of fintech on the global level, the industry has only realized a fraction of its true potential.

“The real opportunity lies in emerging markets, which are still largely untapped due to the lack of access to financial services,” said Amiri. “With close to 70% of its population having either limited or no access to financial services, the [MEA] region sits on a large pool of opportunities that are constantly fueled by the increasing need for financial solutions.”

Besides the region’s large unbanked population, other fintech growth drivers in MEA include high smartphone adoption rates, consumers’ preference for digital, mobile-based financial solutions, and dynamic financial sectors, the report says.

MEA’s fintech industry

In MEA, the United Arab Emirates (UAE) is rapidly emerging as a startup center and launchpad for the regional financial sector with the most prominent destinations being Dubai and Abu Dhabi. Today, the UAE is home to approximatively one third of fintech startups in the region, and Dubai is showcasing increased focus on blockchain with the establishment of the Global Blockchain Council, founded in 2016, by the Dubai Future Foundation, among other initiatives.

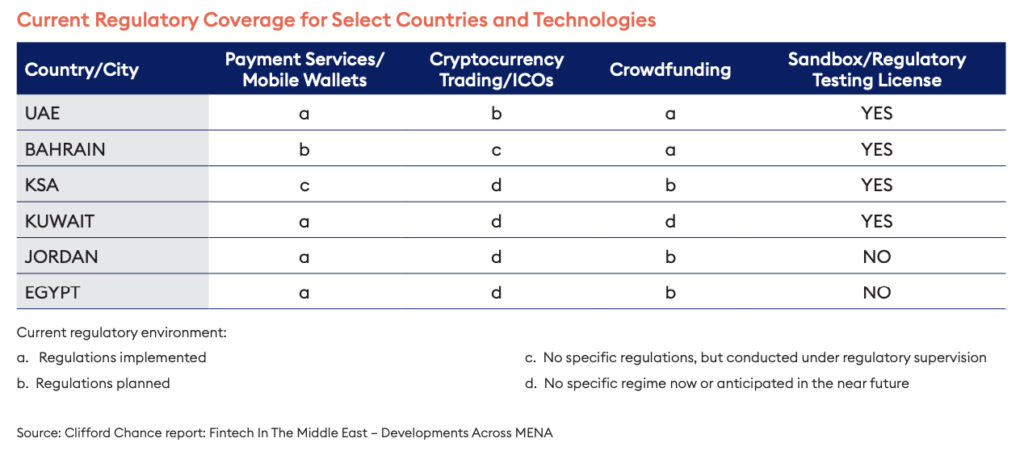

In Bahrain, the government is taking several steps to develop its fintech ecosystem as part of economic diversification, growth and job creation. These include launching a fintech regulatory sandbox in 2017 and introducing crowdfunding regulations.

In Saudi Arabia, the central bank has launched the Fintech Saudi initiative which seeks to promote and develop the fintech industry in the Kingdom, and has partnered with the UAE central bank to experiment with digital currency on blockchain for cross-border payments.

Regulatory coverage for select countries and technologies, A Roadmap for Fintech Firms Entering the Fast-Growing Emerging Markets, April 2019

Recommendations for fintechs entering MEA

The report also shares seven recommendations for foreign fintechs looking to enter MEA. These are based on interviews of a selection of fintech firms as well as venture capital funds and banks.

Balance market research and on-the-ground testing: Interviewees recommend a blend of market research and strategic planning before pursuing the region, in addition to on-the-ground proof-of-concepts to confirm interest and value proposition.

Use “clustering” to prioritize country penetration: Although each country across the region is unique, many share similar characteristics. Fintechs should prioritize markets based on similar traits.

For those offering fintech solutions to banks, these should target local and regional banks. Local and regional banks are often easier to sell to than global banks with offices in the region.

Tailor the solution to the market: Fintechs can leverage artificial intelligence (AI) and machine learning to make applications more insightful and ease the process of tailoring these to unique cultural dynamics.

Prepare for fast and slow periods while adapting to the new market.

Collaborate with partners to benefit from established relationships within the market.

Take advantage of an accelerator to gain exposure to prospective customers, partners, and regulators.

The DIFC is currently home to a community of more than 23,000 professionals, working across 2,100 companies, of which 80 are related to the fintech sector. It operates Fintech Hive, a fintech accelerator program, and a US$100 million fintech fund, launched in 2017.