Saudi Banks Need to Accelerate Digital Transformation Plans Amid COVID-19 Disruptions

27. April 2020Banks in Saudi Arabia have to revisit their digital transformation plans and strive to launch new channels that will sustain delivery of products and services amid the Covid-19 pandemic, according to the findings of a new report released KPMG Al Fozan & Partners (KPMG in Saudi Arabia), the leading provider of audit, tax and advisory services in the Kingdom.

Covid-19 situation has created a dynamic shift in customer expectations and therefore instigated a live test to the existing digital platforms, omnichannel functionalities and mobile capabilities. Banks must be sensitive to this opportunity and create mechanisms to collect, analyze and identify all the improvement opportunities that results from extensive use of digital banking.

KPMG in Saudi Arabia, has published its analysis of Covid-19 impact on the banking sector and the potential countermeasures to cope with the new normal, based on the results of a high-level survey and discussions with C-suit executives in the sector.

The exercise revealed that the impact of the virus outbreak on overall business to be at medium to high levels and could last for three to nine months. The most impacted segment is SME financing, followed by certain products in consumer finance.

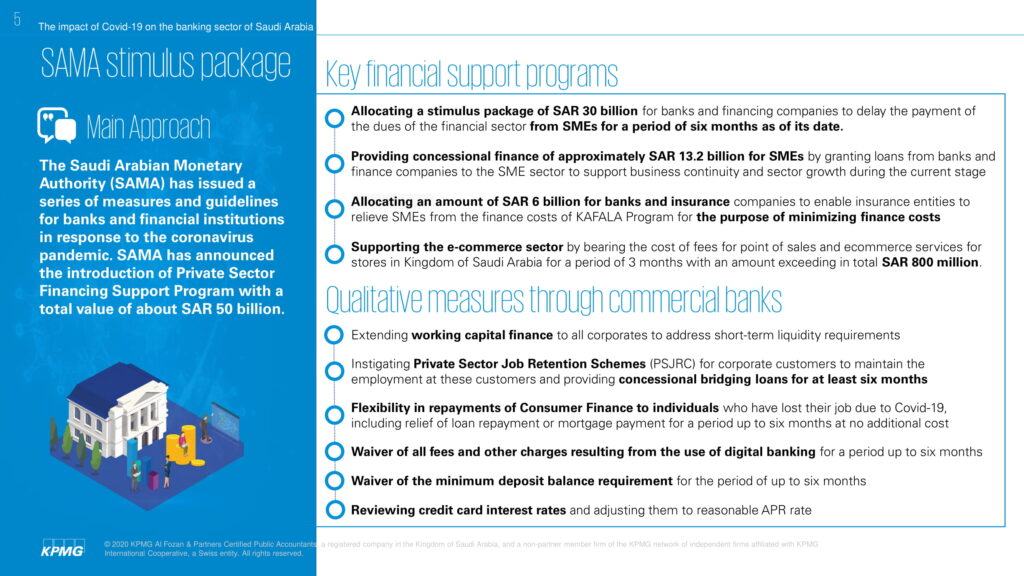

All the banks considered the Saudi Arabian Monetary Authority’s (SAMA) plan as very comprehensive, timely and focused on covering most crucial segments of business; more than half of the respondents to the survey forecast 10-20% of the loan books to undergo restructuring.

It was encouraging to confirm that business continuity management (BCM) measures were found effective in the first two weeks of the outbreak, even though almost all the BCM scenarios did not include a pandemic such the Covid-19.

On the retail banking side, the survey revealed that the closure of travel, hospitality and leisure activities directly impacted credit card utilization. At the same time, volatility in interest rates, deterioration in real estate prices and uncertainties concerning lockdown duration and resulting unemployment led to a significant slowdown in mortgage financing that has reported growth in the first three months of the current financial year.

The KPMG report further offered a set of tools and pointers to navigate in turbulent times and run a risk assessment of the bank in the current, rapidly evolving environment.

Ovais Shahab

Commenting on the report, Ovais Shahab, Head of Financial Services Sector at KPMG Saudi Arabia, said:

” Drastic measures of containment are severely impacting SME and consumer financing. The economic stimulus packages are provided to soften as much as possible economic impacts and stimulate economic recovery. However, the key question for the banking sector is how to respond to its operational and regulatory challenges while contributing in a positive way to the economic recovery.

The main challenges for the banking sector are credit portfolio deterioration, capital impacts, liquidity repercussions, cyber risk, contingency plan activation and continuation of banking services,

he stated.

Since banks play a crucial role in implementing the SAMA and government’s stimulus packages, KPMG recommended a six-step action plan that includes identifying potential risky counterparties, make adjustments to provisions coverage, update liquidity plans, manage recoveries plans, protect the bank and clients from cyber-attacks, and follow a clear and strong communication plan with all stakeholders.

“Banks need to perform a customer-specific assessment in order to offer customized solutions; assess systems and organizational capabilities and proactively revisit the digital transformation plan,”

Shahab concluded.