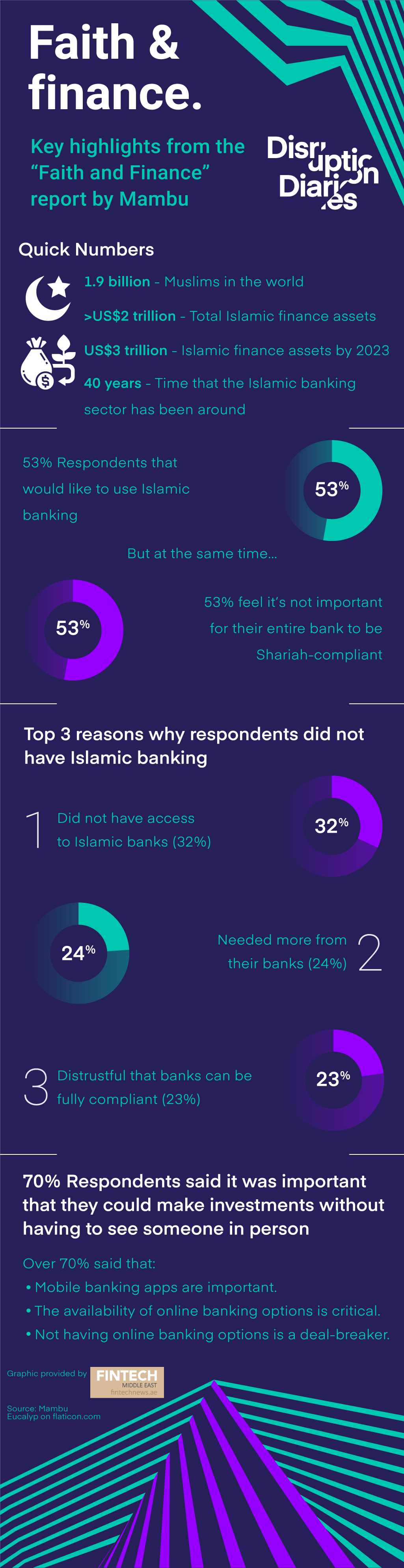

Islamic banking and financial services are picking up pace worldwide. Greater awareness, and improved legal and regulatory structures have helped to accelerate growth in Islamic banking and finance, according to a recent report by Mambu.

The Islamic fintech market, for instance, is expected to be worth US$125 billion by 2025, the report said.

The UK is home to most of these fintech companies, with 27 fintechs located in the country. Malaysia follows with 19 companies, and the UAE is next, with about 15 companies.

Islamic banking, which is based on ethical banking principles that comply with Shariah law, is also popular amongst younger Muslims, the report noted.

Miljan Stamenkovic

“[Young Muslims] want banking services that align with their lifestyle and values, without compromising on flexibility or ease of use,”

Miljan Stamenkovic, General Manager MENA at Mambu, explained.

“The Islamic banking industry is only around 40 years old and has already proven to be tremendously successful — a showcase for the ethical banking opportunity. But with younger generations set to account for three quarters of all Islamic banking revenue by 2023, the industry must listen to the demands of these digital natives, both in the Middle East and beyond, if it wants to stay ahead of the curve.”

Young Muslims want Islamic banking that is ethical, and tech-enabled

Millennials comprised a large percentage of Islamic banking customers, the report said. This demographic is both “technologically savvy” and “more globally mobile” than their predecessors, Stamenkovic noted.

Providing tech-enabled Islamic banking solutions is therefore one of the most important ways to address their needs.

The report suggests using technology to understand their behaviour, and provide hyper-personalised services. API integrations, cloud-based digital platforms and mobile banking solutions, could further help Islamic banks and fintechs expand their reach to these potential customers.

Overall, a tech-forward approach would help to achieve strategic objectives including financial inclusion, user experience, and growth, the report said.

Further, 74% of surveyed individuals said that it was important for investments made using their money to be ethical.

Ethical banking has been finding resonance globally, the report said. For instance, new ethical challenger banks and fintechs such as Starling Bank, Spiral, Banca Ética Latinoamericana and TreeCard have made their way into the market. Meanwhile, Dutch ethical bank Triodos announced record lending in Wales in the past year.

At the same time, over half of the respondents said that it was not important for the entire bank to be Shariah-compliant. They were largely open to investing in ethical portfolios within conventional banks.

This allows banks the flexibility of adding specific Islamic finance products and offerings to an existing portfolio that may not be fully Shariah-compliant, the report suggested.

Islamic banking for millennials and Gen Z at a glance

While technology and ethics were the most important aspects of Islamic banking for young Muslims, there are several barriers of entry that remain to be addressed. In addition, Islamic banking and financial institutions also need to address booming competition within the global banking sector, especially in terms of product offerings and customer experience.

Shakeel Adli

“Islamic finance products need to distinguish themselves from conventional finance in new ways, whether it be through exceptional customer service, or being able to secure finance without seeing someone in person, for example.

All finance offerings need to be commercially viable to work — being legally or ethically sound isn’t enough,”

Shakeel Adli, partner and global head of Islamic finance at international law firm, CMS, said.

1 Comment so far

Jump into a conversation