Six fintech startups from the Middle East made this year’s Fintech 250, CB Insights’ annual list of the 250 most promising private fintech companies in the world.

The 250 winners were selected from a pool of over 12,500 eligible private companies based on CB Insights’ internal benchmarks as well as analyst briefings submitted by applicants.

Factors that were taken into account include funding, market potential, business relationships, investor profile, news sentiment analysis, competitive landscape, team strength, and tech novelty.

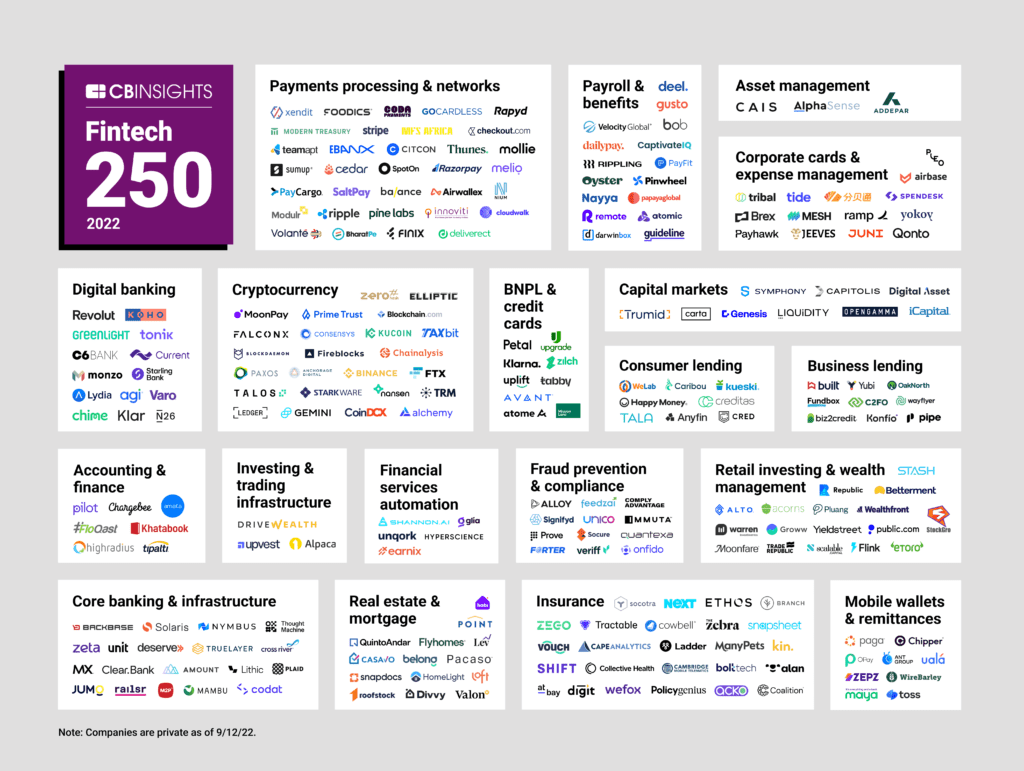

CB Insights Fintech 250: The most promising fintech companies of 2022

According to CB Insights, globalisation is a key theme for this year’s Fintech 250 with winners headquartered in 33 countries across the globe — seven more than last year.

About two-thirds of this year’s Fintech 250 are B2B companies, representing a broader shift in market sentiment away from consumer-facing fintechs.

The categories with the most winners are payments processing and networks, followed by insurance, cryptocurrency, core banking and infrastructure, and retail investing and wealth management.

This year’s Fintech 250 includes 159 unicorns with a US$1 billion valuation, representing almost two-thirds of the total list. These companies raised over US$51 billion across 337 equity deals in 2021 alone.

The Middle East fintech startups on the CB Insights Fintech 250 2022 list:

Foodics (Saudi Arabia)

Foodics is a a cloud-based restaurant management system and point of sale solution. Founded in 2014, the company last raised a US$170 million Series C in April 2022.

Tabby (UAE)

Tabby is a Buy Now Pay Later (BNPL) app that operates in the UAE, Saudi Arabia, Kuwait and Egypt. The company recently secured US$150 million in debt financing.

Earnix (Israel)

Earnix is a pricing analytics and optimisation platform used by insurance and retail banking organizations. The company last raised US$75 million in February 2021.

Hibob (Israel)

Hibob is a cloud-based human resources platform that allows companies to streamline HR processes and engage top talent. Founded in 2015, the company raised US$150 million in August.

LIQUIDiTY (Israel)

Liquidity Group is an investment firm that specializes in providing non-dilutive, non-recourse, and unsecured capital to SaaS-based companies.

StarkWare (Israel)

StarkWare develops zero-knowledge proof technology that compresses information in order to address the scalability problem of the blockchain.

No Comments so far

Jump into a conversationNo Comments Yet!

You can be the one to start a conversation.