A report titled ‘Dubai: The next global hedge fund centre – opportunities and outlook’ – released by Dubai International Financial Centre (DIFC), the leading global financial centre in the Middle East, Africa, and South Asia (MEASA) region, in collaboration with Refinitiv, reveals Dubai’s growth and an increased role as a global hub for hedge funds and alternative investments. DIFC is currently driving this growth and is in discussions with over 60 global hedge funds looking to establish offices within the Centre.

The inaugural publication in the 2023 DIFC Thought Leadership Series delves into essential perspectives on the international hedge fund sector. It emphasizes the swift growth of prominent hedge funds in Dubai and underscores DIFC’s unique offerings as an entry point to the MEASA region while also spotlighting its increasing significance as a worldwide center for hedge fund operations.

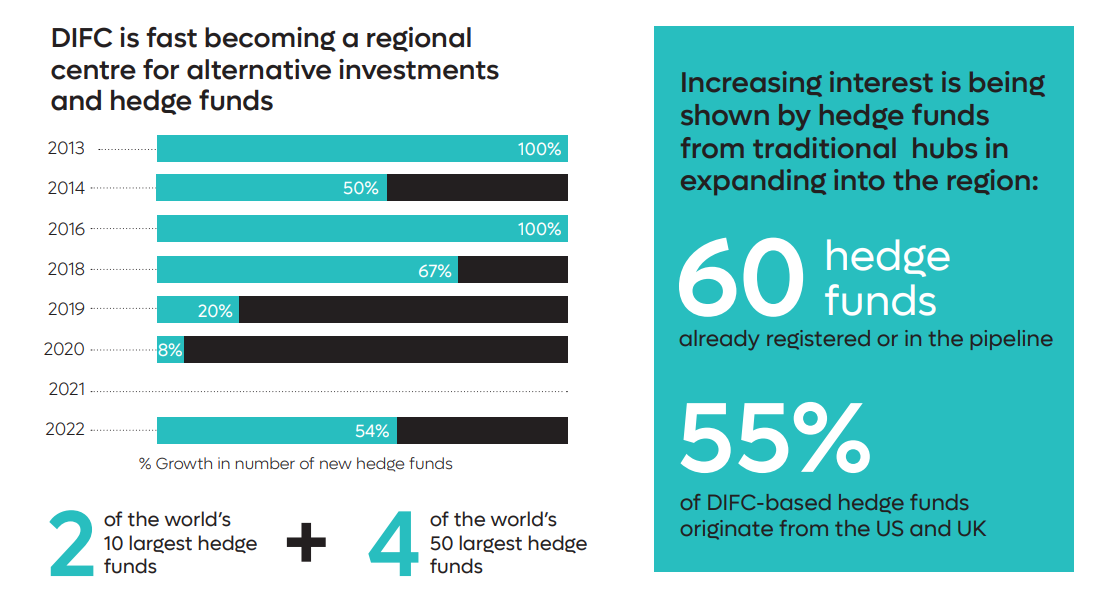

In 2022, DIFC experienced a 54 percent increase in the total number of hedge funds setting up within the Centre, where a strong base of established firms already exists. Approximately two-thirds of DIFC-based hedge funds originate from the US and UK, including two of the world’s ten most significant hedge funds.

As the number and scope of hedge funds established in DIFC grows, the Centre envisions a further deepening of the ecosystem, including smaller-scale hedge funds, additional prime brokers, and technology start-ups. This augmentation of the ecosystem creates a flywheel for talent and firms, further differentiating Dubai as a global hub for hedge funds.

Arif Amiri

Arif Amiri, CEO of DIFC Authority, said:

“DIFC’s remarkable growth significantly contributes to the goal of the Dubai Economic Agenda (D33) to transform Dubai into one of the world’s top three cities for business. It is encouraging to see that we are attracting the attention of international hedge funds, with a record number registering in 2022, up 54 percent YoY, and more in the pipeline. This reflects Dubai’s and DIFC’s ability to keep pace with global economic shifts and to provide an ecosystem for the financial sector that brings new opportunities for growth”.

Nadim Najjar

“Several hedge funds have already begun to expand into new emerging markets as operating environments in their native markets become increasingly challenging. Moreover, long-established markets no longer offer growth prospects or cost efficiencies that can compete with those available in emerging hubs. Hedge funds are showing increasing interest in Dubai as a gateway to the region, looking to establish a presence in DIFC – a rising global hub for alternative investments and hedge funds.”

said Nadim Najjar, Managing Director, Central & Eastern Europe, Middle East & Africa (CEEMA) Refinitiv, an LSEG business.

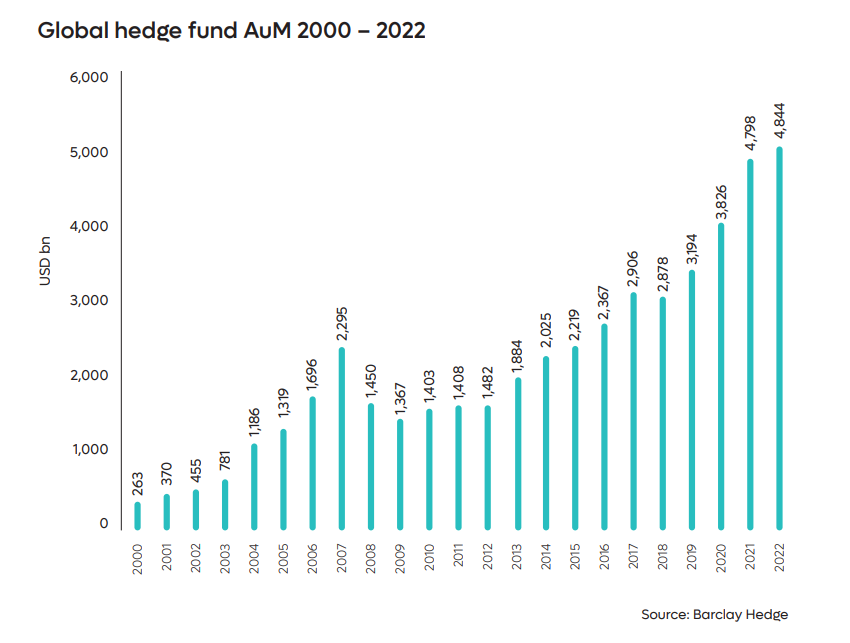

Hedge funds have demonstrated resilience in a challenging global environment, with their global assets under management (AuM) reaching over USD 4.8 trillion at the end of 2022, up one percent from the end of 2021, according to data from Barclay Hedge.

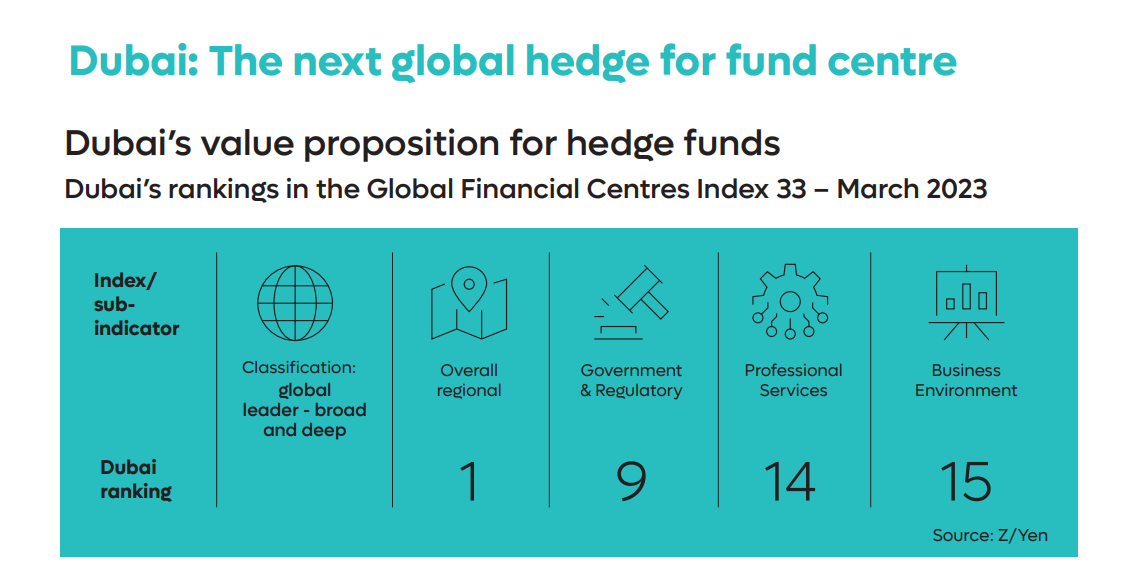

Hedge funds setting up in Dubai will find it an ideal gateway to Western Europe and the high-growth emerging markets of the Middle East, Asia, and Africa. The Global Financial Centre Index places Dubai among the top quartile globally. DIFC is one of only ten financial centres in the world to be classified as a broad and deep global leader and ranked among the top 15 financial centres in terms of the index’s Government and Regulatory, Professional Services, and Business Environment sub-indicators.

DIFC features a strong regulatory framework, supported by the Dubai Financial Services Authority (DFSA), and adheres to English Common Law, which is the international benchmark for financial services. The center also possesses its own civil and commercial legal codes and guidelines. DIFC’s tax-optimized operating environment is geared towards propelling the financial sector’s future.

Furthermore, DIFC’s ecosystem presents an extensive partnership network for portfolio managers seeking to establish themselves in Dubai. Hedge funds can take advantage of a vast and expanding array of support services, such as prime brokers, legal firms, consulting agencies, and tax experts.

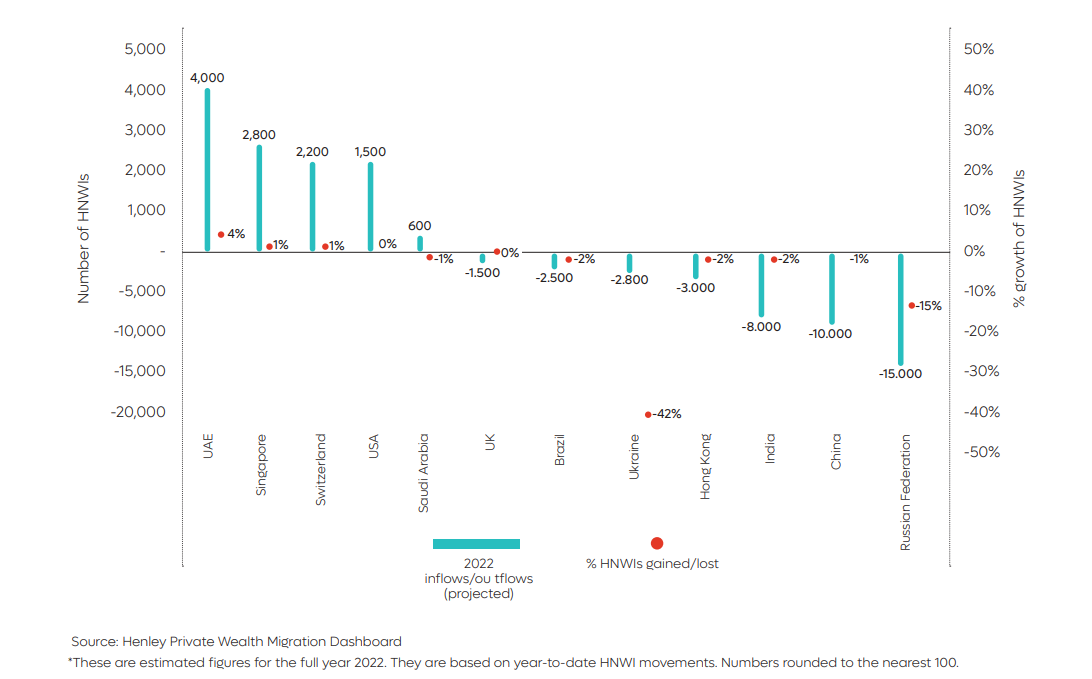

With Dubai and DIFC drawing global financial entities, including hedge funds seeking new operational bases, they simultaneously gain access to the region’s burgeoning retail and institutional wealth. According to the Henley Private Wealth Migration Dashboard, the UAE saw the most significant net influx of millionaires in 2022. The nation’s private wealth is estimated at USD 966 billion, and the high-net-worth individual (HNWI) population is expected to grow by 40 percent by 2031.

Learn more about opportunities for hedge funds by downloading the complimentary ‘Dubai: The next global hedge fund centre – Opportunities and Outlook’ Report here.

The report was unveiled during a DIFC-hosted webinar, where 800 participants registered from the MENA region, US, UK, Europe, Hong Kong, and Singapore. Speakers included Redha Al Ansari, Head of Research MENA, Refinitiv, an LSEG business; Niamh Taylor, Head of EMEA, Schonfeld; Dominic Rieb-Smith, Managing Director, EMEA Head of Prime and Alternative Sales, J.P. Morgan; and Chris Cameron, Director, Conduct Team (Supervision and Authorisations), Dubai Financial Services Authority.

Featured image credit: edited from Freepik

No Comments so far

Jump into a conversationNo Comments Yet!

You can be the one to start a conversation.