Mamo Pay, the MENA region’s highly anticipated peer-to-peer mobile payments app, announced that it has joined Visa’s Fintech Fast Track program, allowing Mamo Pay to reach a wider audience, and benefit from the capabilities, and security of VisaNet, Visa’s global payment network. Through Fast Track, Mamo Pay and Visa will partner on a number of initiatives including launching prepaid cards to accelerate financial inclusion and cashless adoption in Mamo Pay’s key markets.

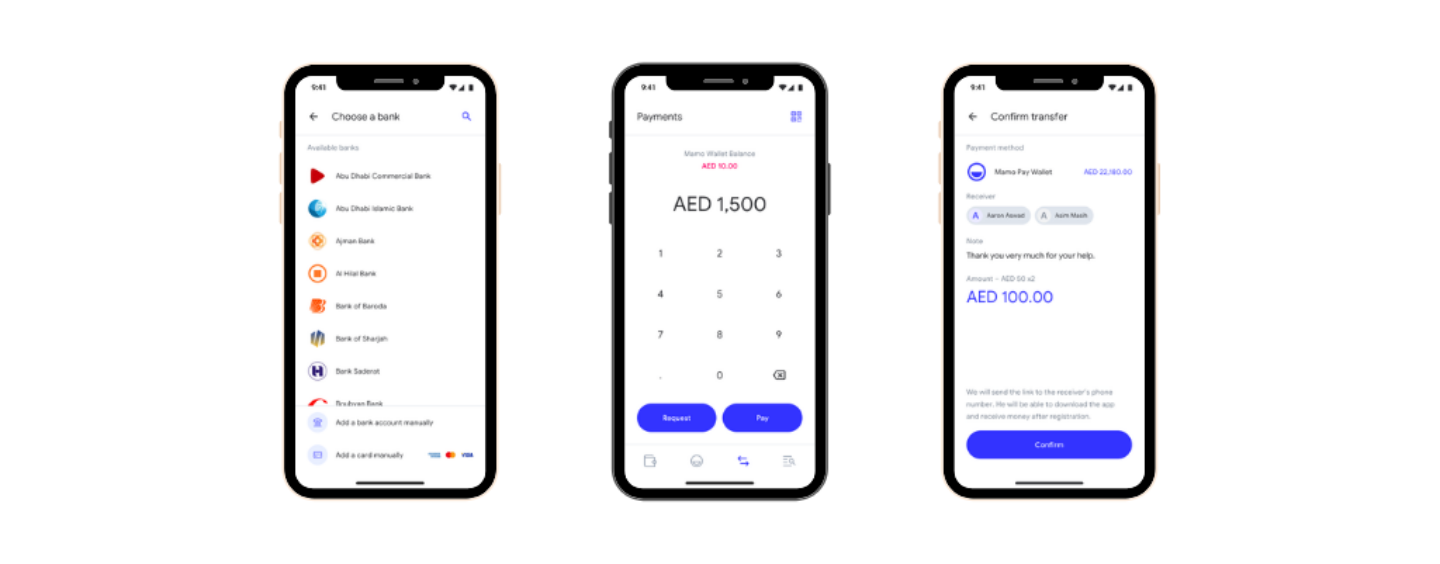

The Mamo Pay platform empowers users and businesses to effortlessly manage their money through an app that demonstrates simplicity, and utility – adopting a customer-first approach. Mamo Pay has a unique empathetic vision that champions mindful and equitable finance coupled with a delightful user-centric experience, and a service that connects with people.

By joining Visa’s Fintech Fast Track Program, Mamo Pay now has the ability to access Visa’s growing partner network and experts helping them integrate with existing financial services in the most efficient way possible.

Mohammad El Saadi

“Less than half of adults in the MENA region have access to a formal bank account, while even those that do, are often forced to rely on cash”,

said Mamo Pay Co-founder Mohammad El Saadi.

“Mamo Pay not only increases speed but removes all of the hassle associated with banking in the MENA region while also providing financial access to those that have been excluded from the traditional financial system. We are excited about partnering with Visa to deliver an intuitive, fast and effortless payments service to users and businesses across the region”

El Saadi continued.

Otto Williams

“By joining Visa’s Fast Track program, exciting fintechs like Mamo Pay gain unprecedented access to Visa experts, technology, and resources,”

said Otto Williams, Vice President, Strategic Partnerships, Fintech and Ventures, CEMEA at Visa.

“Fast Track lets us provide new resources that rapidly growing companies need to scale with efficiency. We’re delighted to welcome Mamo Pay into our program and look forward to working with them on their payment solutions that will help promote financial inclusion in the MENA region.”