In the United Arab Emirates (UAE), the digital shift brought about the COVID-19 pandemic has introduced new business opportunities to freelancers and small and medium-sized enterprises (SMEs).

A new study conducted by online payments giant PayPal, in partnership with British market research and data analytics firm YouGov, found that not only have SMEs and freelancers swiftly changed their business practices to adjust to COVID-19 restrictions, they’ve also successfully capitalized on the new opportunities introduced by booming digital adoption, including the ability to grow their businesses leveraging online channels and digital payments, and expanding into new markets.

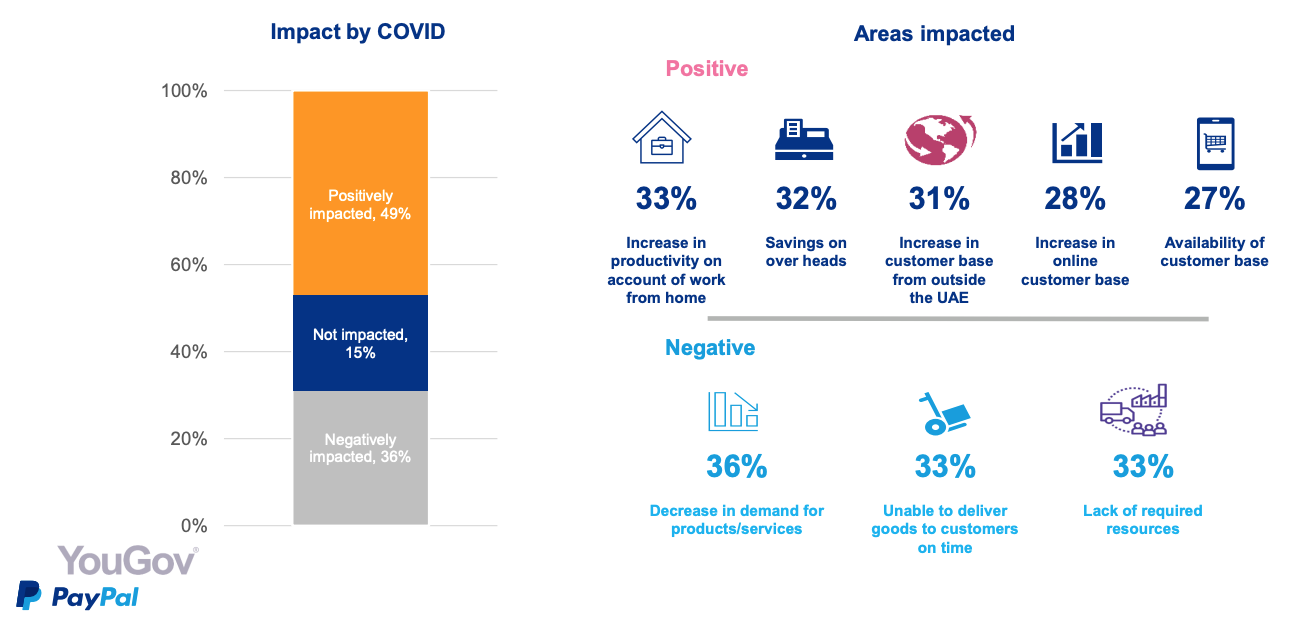

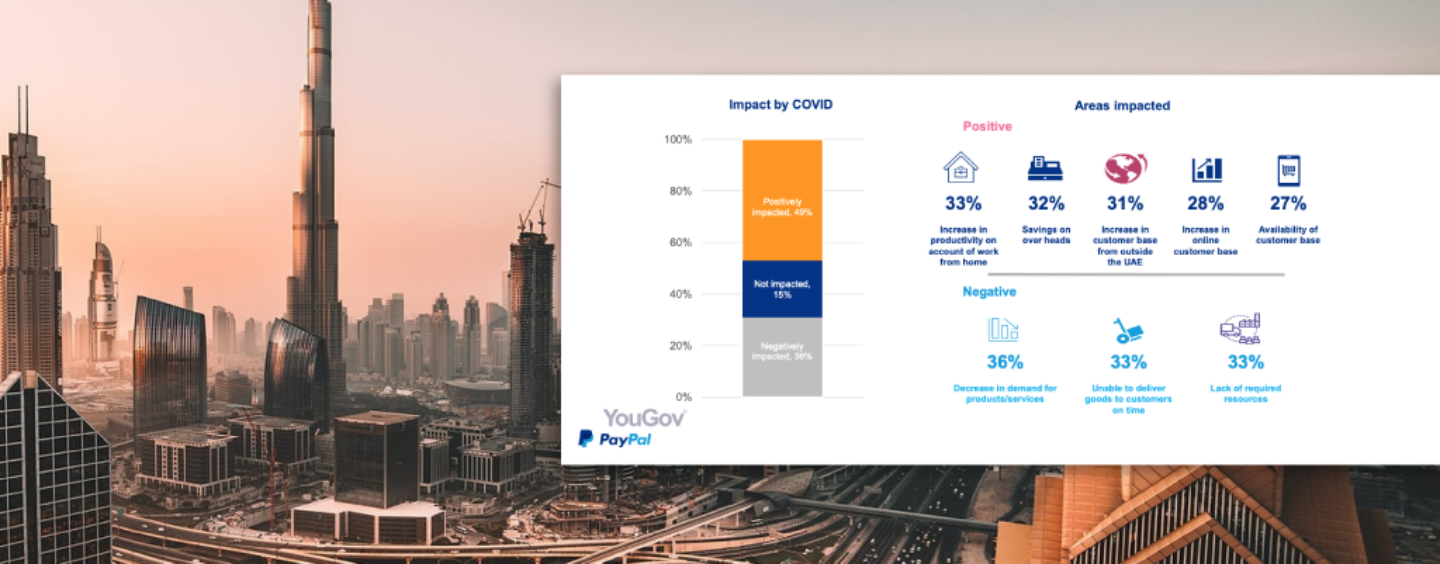

Conducted between January and February 2022, the study polled 300 SMEs and freelancers in the UAE to analyze the impact of COVID-19 on small businesses and found that nearly half of respondents indicated seeing a positive impact of the pandemic on their business.

Major positive outcomes cited include increased productivity on account of work from home (33%), savings on over heads such as travel and real estate (32%), and increased customer base from outside the UAE (31%), indicating that businesses were able to sustain growth without the need for a physical space.

Some are even performing better than pre-COVID-19, with 28% of respondents recording an increase in their customer base and 31% reporting an increase in customers from outside of the UAE. The rest of the Middle East, Europe (39%) and Asia (37%) were found to be the top three foreign markets and regions for UAE freelancers and SMEs.

Impact of COVID-19 on UAE SMEs and freelancers, Source: UAE SMB and Freelancer Digital Readiness Survey, PayPal:YouGov, March 2022

Online commerce and digital payments become prerequisites

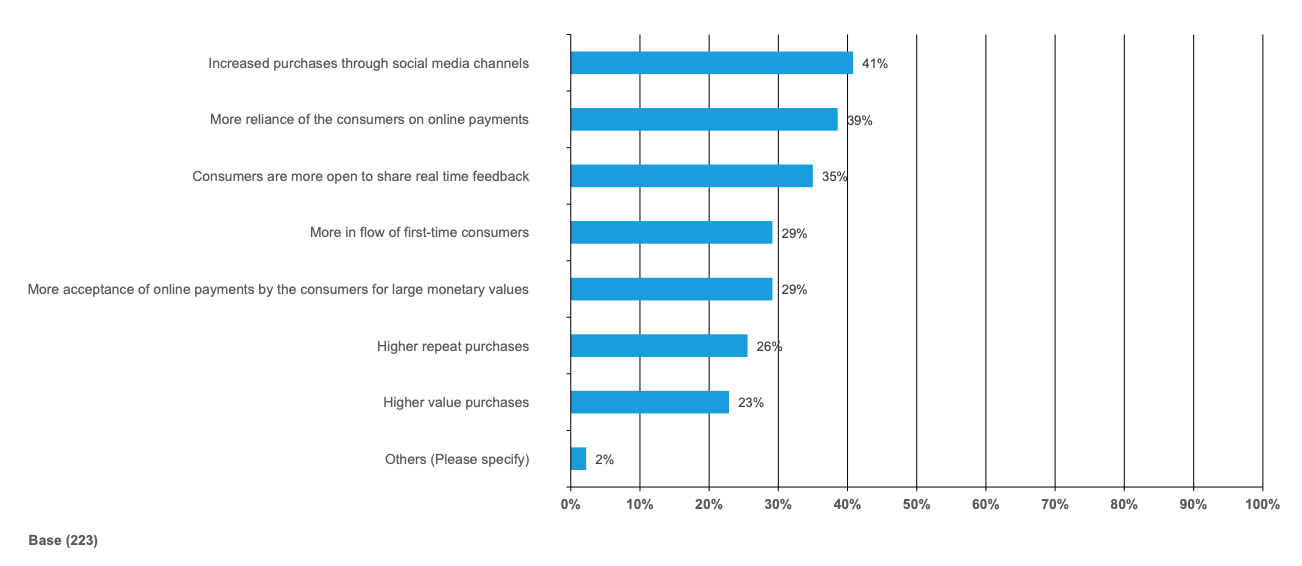

Results from the survey show a major digital shift in consumer behavior because of COVID-19, notably with rising social commerce and digital payments adoption. 41% of freelancers and SMEs in UAE indicated increased purchases through social media and 39% said they’ve observed increased usage of online payments by customers.

Consumer behavior changes, Source: UAE SMB and Freelancer Digital Readiness Survey, PayPal/YouGov, March 2022

Further evidence of that is the rise in business sales seen by businesses that have integrated digital payments. Of the UAE SMEs and freelancers surveyed, 65% of respondents indicated an increase in sales resulting from using payment gateway services, showcasing that providing online payment capabilities has become a prerequisite for companies.

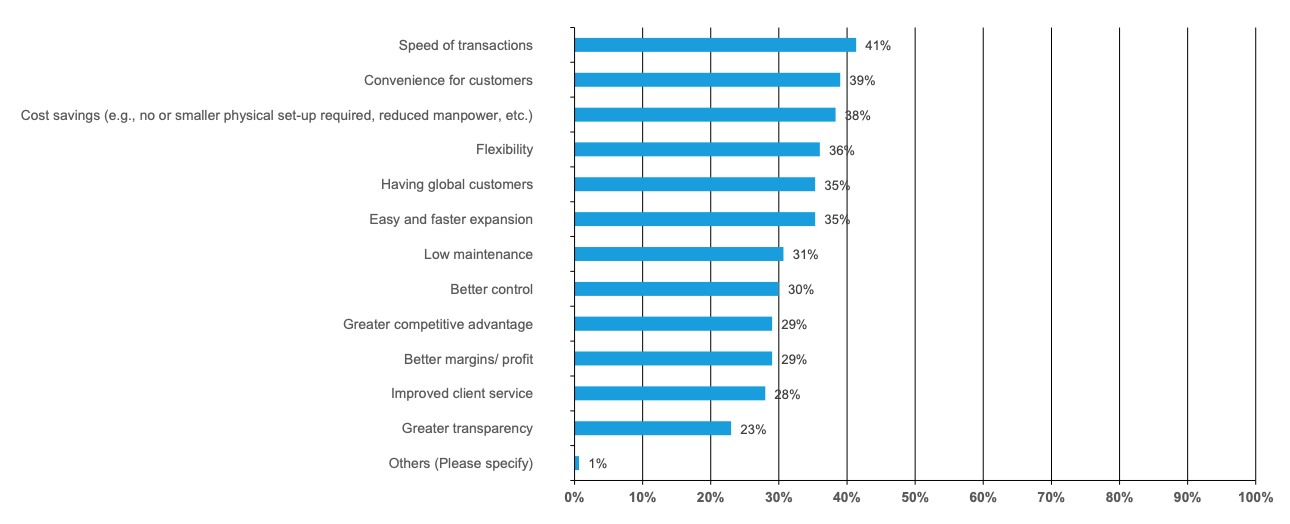

Not only are consumers enjoying making purchases from their mobile phones or desktop computers and paying for them electronically, but businesses themselves are appreciating the benefits brought about digital channels. When asked about the top advantages of conducting business online, 41% of SMEs in UAE indicated speed of transactions, 39% cited convenience, and 38% indicated cost savings.

Advantages of conducting a business online, Source: UAE SMB and Freelancer Digital Readiness Survey, PayPal/YouGov, March 2022

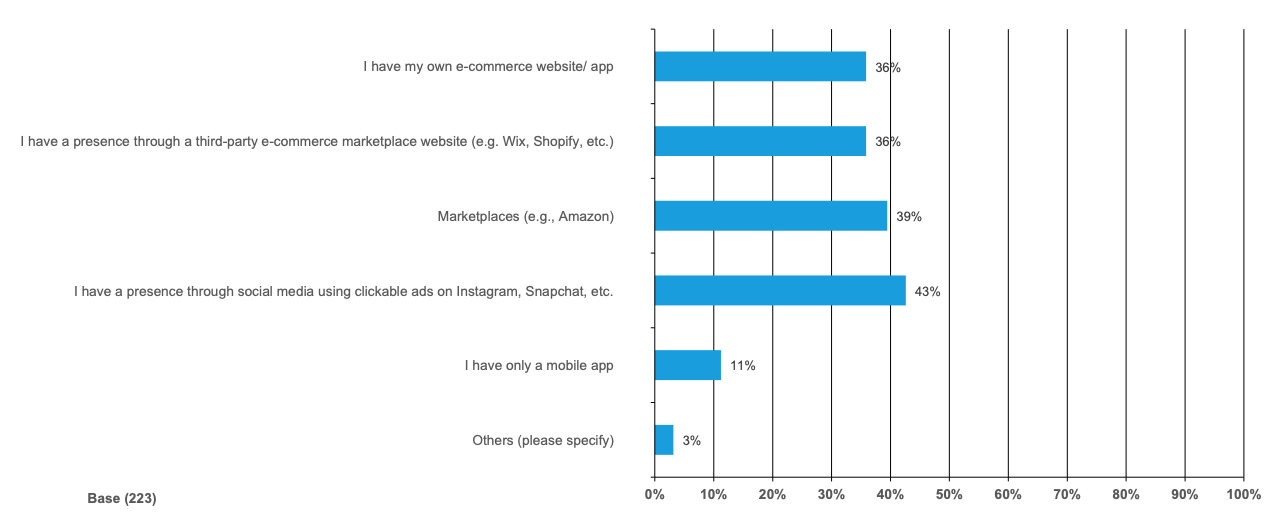

As a result, businesses and freelancers in the UAE are significantly increasing their presence online, with 43% of respondents indicating now having a presence through social media using clickable ads. 39% said they are present on marketplaces like Amazon, 36% said they use third-party e-commerce marketplace website such as Wix and Shopify, and 36% said they have their own e-commerce website or app.

Online channels for businesses, Source: UAE SMB and Freelancer Digital Readiness Survey, PayPal/YouGov, March 2022

Findings from the PayPal/YouGov study echo those of an earlier survey by Visa which found booming adoption of digital payments and cashless transactions.

52% of surveyed consumers in the country said they plan to become cashless by 2024 or are already cashless. To meet customers’ expectations, 71% of surveyed SMEs in the UAE indicated being either already cashless or planning to become cashless by 2024.

Accelerated adoption of digital payments comes on the back of surging e-commerce activity. In 2020, the UAE retail e-commerce market reached a record of US$3.9 billion, representing a 53% year-over-year increase, an analysis by Dubai Chamber of Commerce and Industry shows.

The sector continued to grow in 2021, reaching just over US$5 billion, industry experts estimate. By 2025, total e-commerce in the UAE is projected to surpass US$8 billion.

No Comments so far

Jump into a conversationNo Comments Yet!

You can be the one to start a conversation.