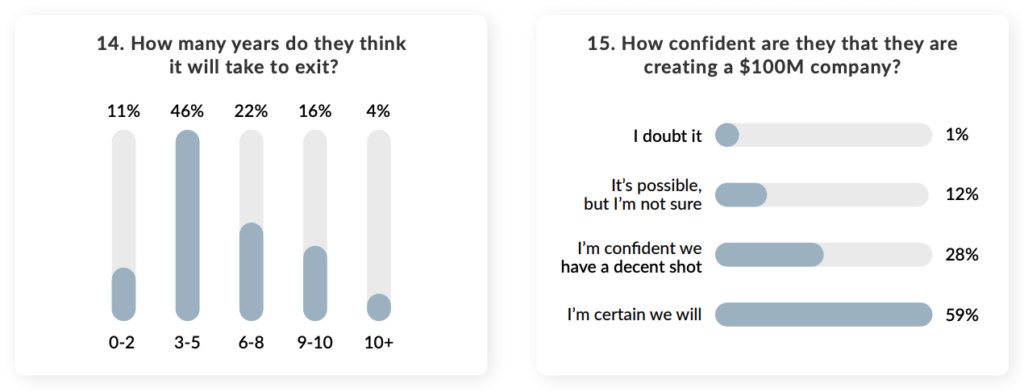

57% of startup founders in the Middle East and North Africa (MENA) region are confident they will exit their startup within the next five years, with 59% of them “certain” they will sell for a US$100 million valuation or higher, according to findings from a new survey conducted by startup data platform Magnitt and venture capital (VC) firm 500 Startups.

via State of MENA Startups 2019, Magnitt & 500 Startups, October 2019

The confidence and optimism come at a time when tech-enabled startup companies in MENA are maturing rapidly, and with that, attracting global and regional attention from potential acquirers.

So far this year, 20 startup exits were recorded, according to Magnitt’s Q3 2019 MENA Venture Investment report, released earlier this month. Main exits include Careem’s US$3.1 billion acquisition by Uber, the first unicorn exit in the region, as well as Dubai’s Emaar Malls acquisition of online fashion retailer Namshi, and Majid Al Futtaim’s purchase of online grocery retailer Wadi. Initial public offerings this year include Egypt’s digital payments company Fawry and the United Arab Emirates (UAE)’s payments processor Network International.

Philip Bahoshy, founder of Magnitt, believes 2019 will be a record year for startup exits in the region.

“We … expect to see more exits, whether through mergers or acquisitions, in 2019 than any previous year,” Bahoshy said. “We predict that 2019 will see more international investors, many of whom will be new, investing in MENA based startups than any previous year.”

State of MENA Startups 2019

The Magnitt/500 Startups joint report, titled State of MENA Startups 2019, outlines results of a survey of over 100 high-growth tech startup founders in the MENA region that have received at least one round of investment from 500 Startups. Most of these startups are based in Dubai (27%), followed by Cairo (23%) and Riyadh (11%) with e-commerce being the dominant industry, accounting for 23% of startups, followed by fintech at 14%.

According to the study, more than half of all startups (54%) were founded in 2017 or later, and have founders who are in their early 30s (45%). 43% of them have ten or less full-time employees.

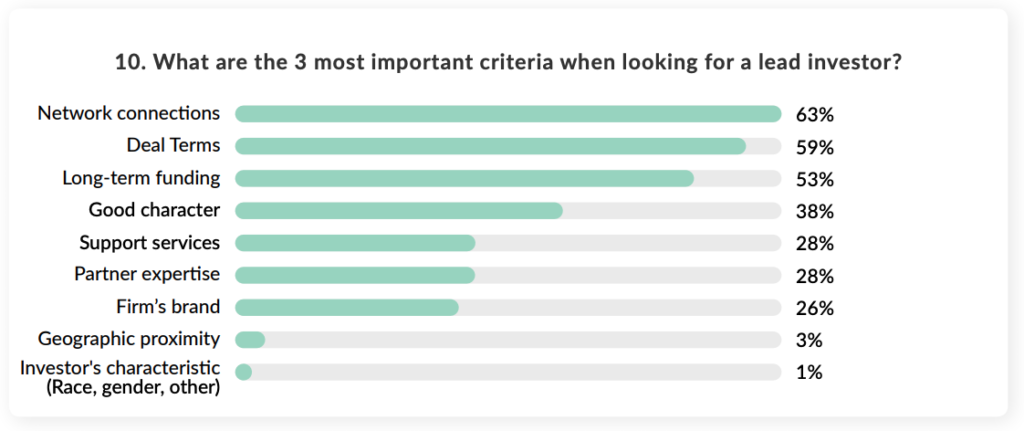

On average, it took these startups seven months to close their funding round, during which most pitched to between six and ten investors. Founders cited network connections, deal terms and long-term funding opportunities as the three main criteria when choosing a lead investor.

via State of MENA Startups 2019, Magnitt & 500 Startups, October 2019

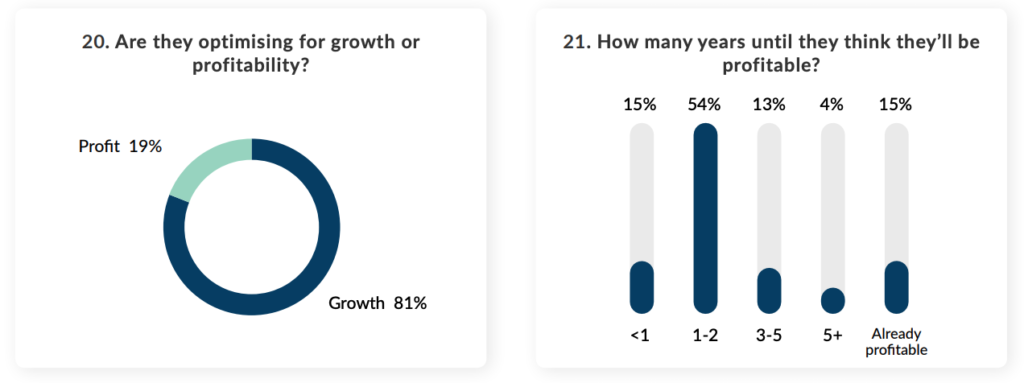

For high growth-companies, scale is the name of the game and reflecting on that, 81% of startup founders said that as a business they focus on optimizing for growth over profitability. Nevertheless, 69% believe that they will be profitable within the next three years, and 15% said they already are profitable.

via State of MENA Startups, Magnitt & 500 Startups, October 2019

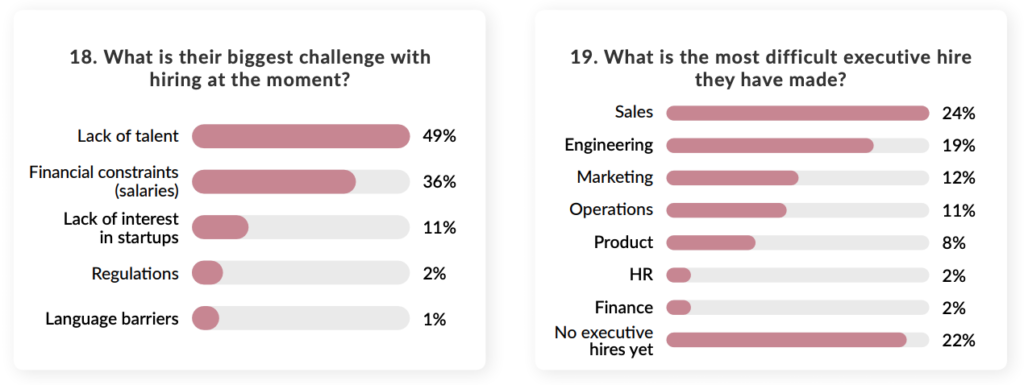

Among the main challenges faced by MENA startups, founders cited hiring talent, with 49% highlighting a lack of talent as the main concern, with sales (24%) and engineering executives (19%) being the most difficult hires. 22% of founders even said they have made no executive hires yet.

These findings suggest that currently, startups face two major hindrances when hiring high-quality talent: first, the lack of specialized skills in some sectors, and second the inability to compete on salaries, the report says.

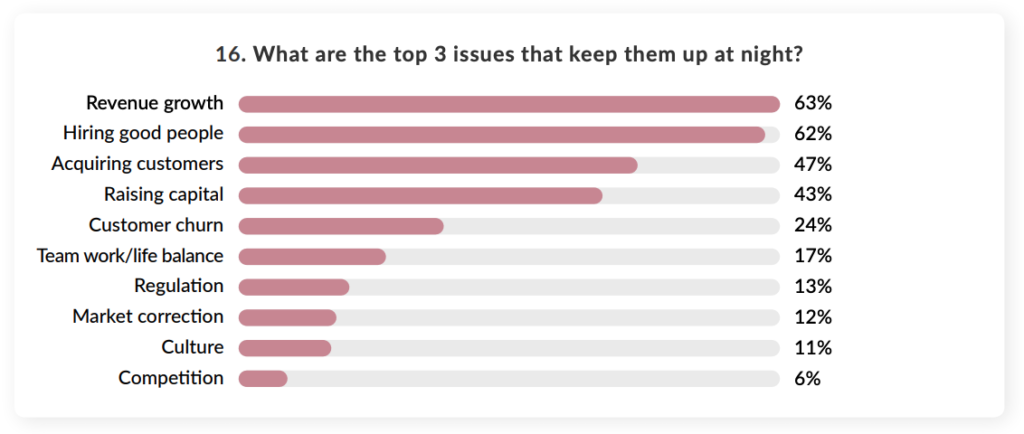

via State of MENA Startups 2019, Magnitt & 500 Startups, October 2019

via State of MENA Startups 2019, Magnitt & 500 Startups, October 2019

The startup ecosystem is growing quickly in MENA with US$517 million being invested in 354 deals so far this year. This is an increase of 30% compared to the same period of 2018, with a 3% increase in the number of deals, according to Magnitt’s Q3 2019 MENA Venture Investment report.

Fintech received the largest number of investments, accounting for 14% of all deals.

Major investors in the region include VC firms such as 500 Startups as well as accelerator programs such as Flat6Labs.

Featured image credit: Unsplash