Dubai, a city known for leading technological innovation and digital transformation, has emerged as the fintech hub of the Middle East and Africa (MENA) and South Asia region due to its emphasis on building a modern, digitally-driven, and innovative economy.

The city has been investing heavily in its fintech infrastructure, creating a conducive environment for startups and established companies to flourish.

Dubai has implemented several initiatives to promote and support the fintech industry’s growth. This includes the creation of innovation hubs and accelerator programs, tax incentives, grants, funding opportunities, and a favourable regulatory environment.

Fintech industry in MENA

The fintech ecosystem in the region, particularly in United Arab Emirates, Saudi Arabia, Egypt, and Bahrain, is being bolstered by various initiatives. These include regulatory sandboxes such as DIFC’s Innovation Testing License (ITL), the Egypt fintech sandbox, and Saudi Central Bank (SAMA) regulatory sandbox in Saudi Arabia and free zone Dubai International Financial Centre (DIFC).

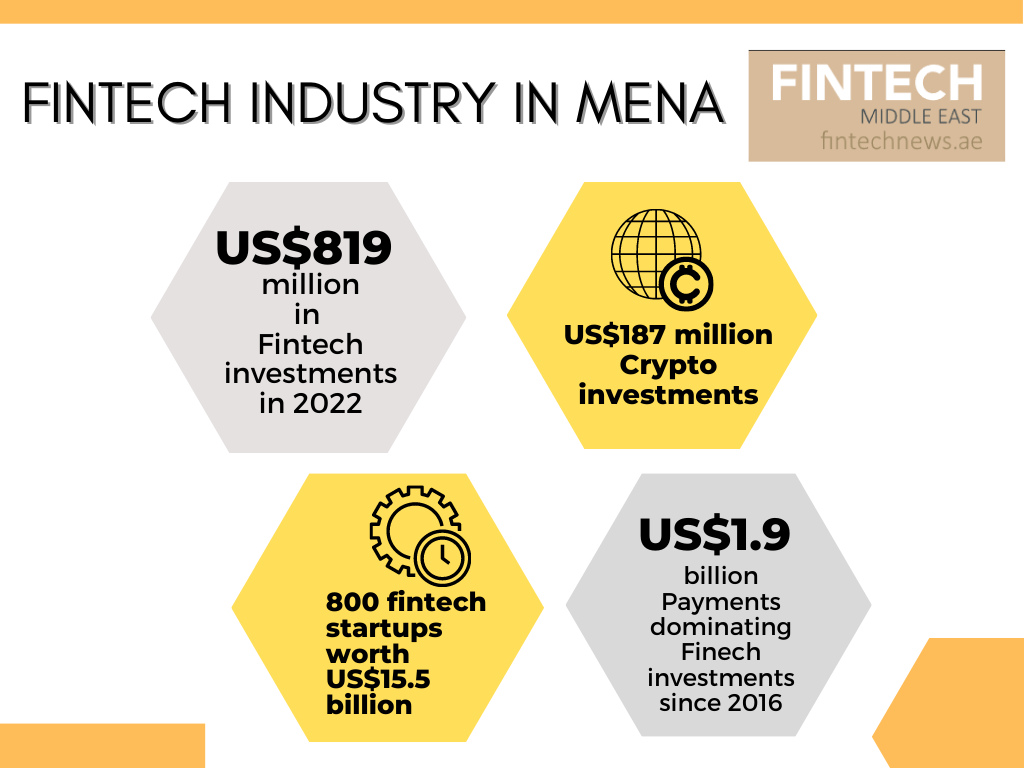

Fintech investments in the MENA region have surpassed US$819 million in the first half of 2022, nearly double the previous record. Additionally, investments in cryptocurrency in the MENA region have skyrocketed to US$187 million.

With over 800 fintech startups worth US$15.5 billion, the MENA region’s fintech ecosystem is relatively young. However, startups founded since 2015 have already generated most of their value.

Factors driving Dubai’s success as a fintech capital

Dubai has a thriving ecosystem of more than 600 fintech startups covering a range of financial services sectors, including payments, remittances, lending, and insurance, among others.

One of the factors contributing to Dubai’s success as a fintech hub is its supportive government policies. The government has launched several initiatives to promote the growth of the fintech sector, including the Dubai Future Foundation, which focuses on exploring and investing in emerging technologies.

Dubai is also home to several leading innovation centers, including the Dubai Internet City and Dubai Silicon Oasis, which provide startups with access to the resources and support they need to succeed.

The Dubai Future Accelerators programme, has also played a significant role in attracting venture capital investment to the fintech sector. The programme provides fintech startups and established companies with access to funding, mentorship, and a network of industry experts and partners, all of which help to attract venture capital investment.

In addition, the city’s fintech sector boasts another crucial advantage: its proximity to other vital markets in the Middle East Africa South Asia (MEASA) region, such as the Gulf Cooperation Council nations, India, and Africa.

This location offers fintech companies the ease of expansion into these markets and the ability to meet the increasing demand for financial services.

With the introduction of the UAE’s Golden Visa, which offers long-term residency to entrepreneurs, Dubai has also gained a competitive advantage in attracting and retaining talent in the city.

Dubai International Financial Centre (DIFC)

A key initiative that has contributed to the city’s success is the Dubai International Financial Centre (DIFC).

The DIFC is a tax-free zone that offers a range of services and facilities to support the growth of fintech companies, including access to a large pool of talented professionals, a state-of-the-art infrastructure, and a favorable regulatory environment.

The centre accommodates the FinTech Hive, MEASA region’s first and largest financial technology accelerator, and the Innovation Hub, the region’s most extensive innovation community, currently providing a home to over 600 growth-stage tech firms.

Moreover, the DIFC has over 4,000 registered companies and nearly 30,000 professionals, representing the MEASA region’s most extensive and diverse industry talent pool.

Dubai cementing itself in the global fintech landscape

Dubai’s position as a fintech hub in the Middle East and Africa looks set to strengthen further. The city’s government and regulatory authorities are actively working to create an enabling environment for innovation and entrepreneurship.

In addition, the city’s advanced digital infrastructure, strong financial services sector, and strategic location at the crossroads of Europe, Asia, and Africa make it an ideal base for fintech firms looking to access a rapidly growing market of tech-savvy consumers.

As the fintech sector continues to mature, Dubai’s strategic location, favorable business environment, and advanced digital infrastructure are expected to attract more fintech companies and investors to the region, cementing its status as a critical player in the global fintech landscape.

No Comments so far

Jump into a conversationNo Comments Yet!

You can be the one to start a conversation.