Between 2017 and 2022, the number of fintech companies in Egypt increased by 5.5 times, soaring from a mere 32 players five years ago to now 177. This rapidly expanding ecosystem is arising on the back of soaring demand for digital financial services and fintech-enabled solutions, a new report by Fintech Egypt, the fintech and innovation department of the country’s central bank, says.

Growth of fintech startups and payment service providers in Egypt in the last five years, Source: Egypt’s Fintech Landscape Report 2023, Fintech Egypt, July 2023

The report, titled Egypt’s Fintech Landscape Report 2023 and released last month, looks at the state of fintech in the Northern African country, highlighting the industry’s recent developments and sharing findings of a 2022 survey that polled 250 stakeholders in the ecosystem.

According to the report, the Egyptian fintech sector is growing at a fast-pace amid rapid adoption of digital financial services and increased demand for digital capabilities. Nearly nine in ten consumers in Egypt reported last year that they had used at least one emerging payment method over the prior 12-month period, a 2022 Mastercard survey found. These consumers included 35% who used tappable smartphone mobile wallets, 27% who used a digital money transfer app, and 24% who used QR codes.

Usage of digital banking is also on the rise with data from the Central Bank of Egypt revealing in December 2022 that 14.4 million people out of the country’s 104.4 million population were Internet banking users, while 13.2 million were mobile banking users, implying a 10%+ penetration rate in both cases.

Findings of the industry survey found that Egypt’s 177 fintech companies combined a total of 99.9 million registered individual and business customers. Of these 99.9 million, 55%, or 54.7 million are active customers.

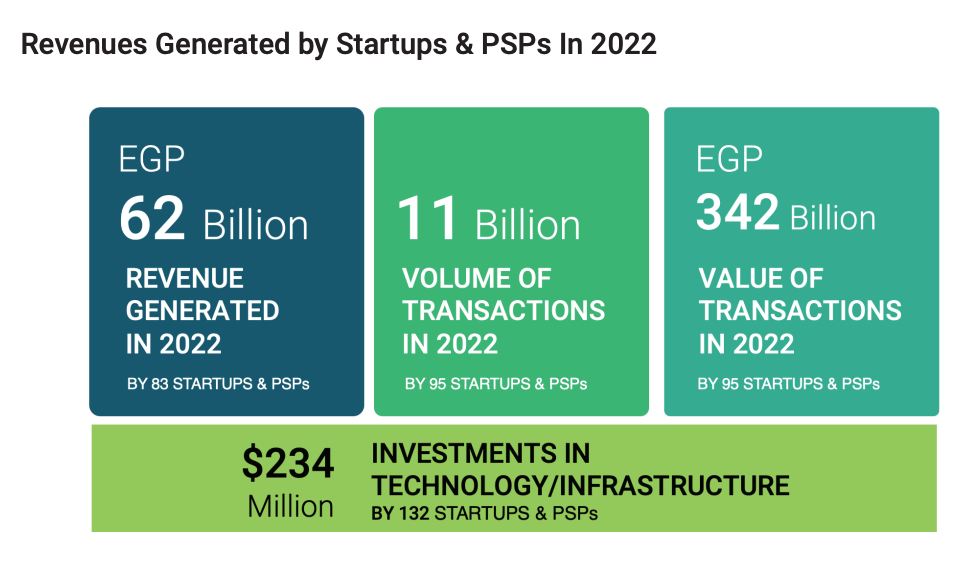

About 90 of the Egyptian fintech companies polled said they generated a combined EGP 62 billion (US$2 billion) in revenue last year. These companies processed 11 billion transactions for a total value of EGP 342 billion (US$11 billon).

Revenues generated by Egyptian fintech companies in 2022, Source: Egypt’s Fintech Landscape Report 2023, Fintech Egypt, July 2023

Highlighting the growth of Egyptian fintech startups, the report notes that about 30% of these companies have expanded to regional and global markets. The United Arab Emirates (UAE) was found to be the most popular destination, with more than half of the 46 companies that have established additional offices overseas indicated having a presence in the country. The UAE is followed by Saudi Arabia (36%), Jordan (11%) and Bahrain (11%), findings that showcase Egypt’s strong regional relationships with Gulf countries.

Egyptian fintech startups and payment service providers global geographical representation, Source: Egypt’s Fintech Landscape Report 2023, Fintech Egypt, July 2023

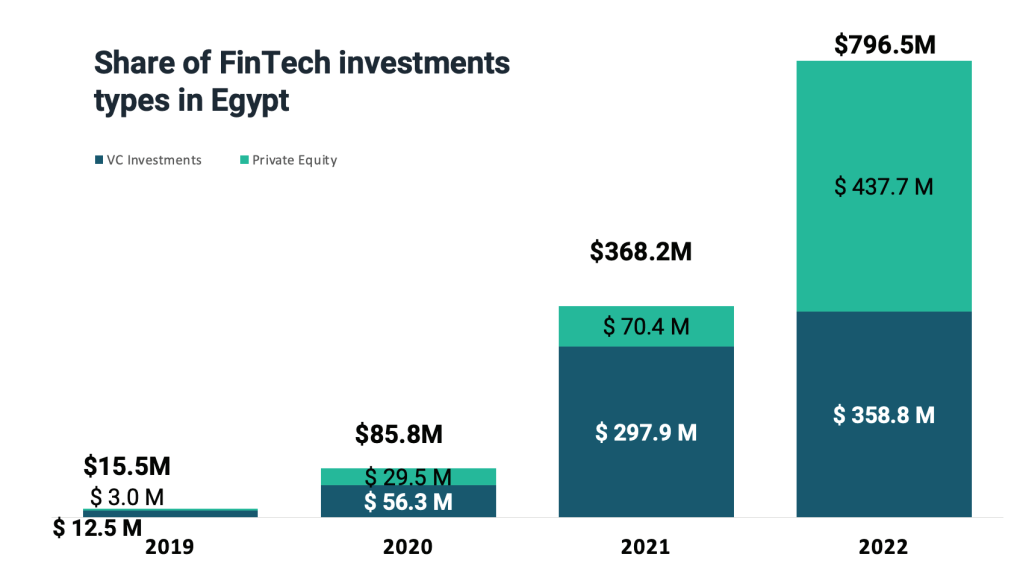

In addition to a burgeoning startup ecosystem, fintech investments are also reaching new heights. In 2022, Egyptian fintech companies and payment service providers secured a total of US$796.5 million in venture capital (VC) and equity funding, more than double 2021’s US$368.2 million and 51 times 2019’s US$15.5 million.

Fintech investments in Egypt, Source: Egypt’s Fintech Landscape Report 2023, Fintech Egypt, July 2023

Egypt’s fintech startup ecosystem

More than 170 fintech companies are currently operating in Egypt. 95% of these companies are headquartered in Egypt while the remaining 5% are foreign companies that have established a presence in the country.

14 segments now comprise the Egyptian fintech sector, with payments and remittance (36%), lending and alternative finance (11%) and business-to-business (B2B) marketplaces making up for nearly 60% of all fintech companies in the country.

Other segments represented include data analytics and artificial intelligence (AI) (5%), insurtech and healthtech (5%), agritech (5%), open banking and infrastructure (5%), and personal finance management and financial literacy (5%), the research found.

Egypt has one of the largest and most dynamic fintech ecosystem in the Middle East and North Africa (MENA). In 2022, the country attracted 20% of all fintech funding in MENA, the third largest share behind only the UAE (37%) and Saudi Arabia (25%), data from consulting firm McKinsey show.

Today, Egypt is home to some of the most successful fintech companies in the region, including unicorn startup MNT-Halan, omni-channel merchant financial services platform Paymob, and digital payment and fintech platform Fawry.

Fintech Egypt claims that supportive and enabling initiatives from the government have allowed for the sector to flourish. Last year, the central bank issued its Financial Inclusion Strategy 2022 – 2025, a national development plan focusing on expanding access to financial services, developing financial literacy and facilitating the introduction of innovative financial products that meet consumers as well as micro, small and medium-sized enterprises (MSMEs)’ needs. 2022 also saw the release of new rules on mobile payment services covering interoperability for cash in and out through aggregators as well as mobile wallets dormancy.

Several initiatives and regulations are now in the works including a digital banking licensing and regulatory framework, cloud computing rules, a new law to regulate alternative finance activities, as well as rules on digital authentication and digital onboarding.

Featured image credit: Edited from Unsplash

No Comments so far

Jump into a conversationNo Comments Yet!

You can be the one to start a conversation.