Burcu Küçükünal, the Digital, Design and Innovation SVP at one one of Turkey’s most prominent private banks, Akbank, recently discussed her team’s aim to introduce a mobile app as a dependable financial counselor for their clientele, enhancing customer involvement with Personetics.

In her presentation at the Money 20/20 conference in Amsterdam titled “The Journey to Financial Data-Driven Personalization,” Burcu highlighted the positive uptick in client engagement and satisfaction Akbank experienced after introducing hyper-personalized insights. She went on to map out the bank’s aspirations for heightened personalization and plans to amplify customer engagement further.

Akbank’s Initial Customer Engagement Strategy

Considering Turkey’s youthful populace, where half are below 35, and a robust digital user base of 10 million, Akbank sought to establish a compelling digital tool. This platform would serve as a financial ally, sparking customer dialogue through bespoke interactions.

Burcu expanded on the bank’s ambitions, which included aiding customers in adept money management and achieving their fiscal goals, enhancing engagement through tailored insights, fostering stronger personal ties during every customer interaction, and setting Akbank apart as a pioneer in the digital banking sphere.

Akbank Teams With Personetics To Create ‘Banking IQ’

To realize these aims, Akbank joined forces with Personetics. They started by rolling out the “Banking IQ” feature, which delivered 25 unique insights related to an individual’s financial health, such as spending habits, past cash movements, and recommendations to bolster their financial position.

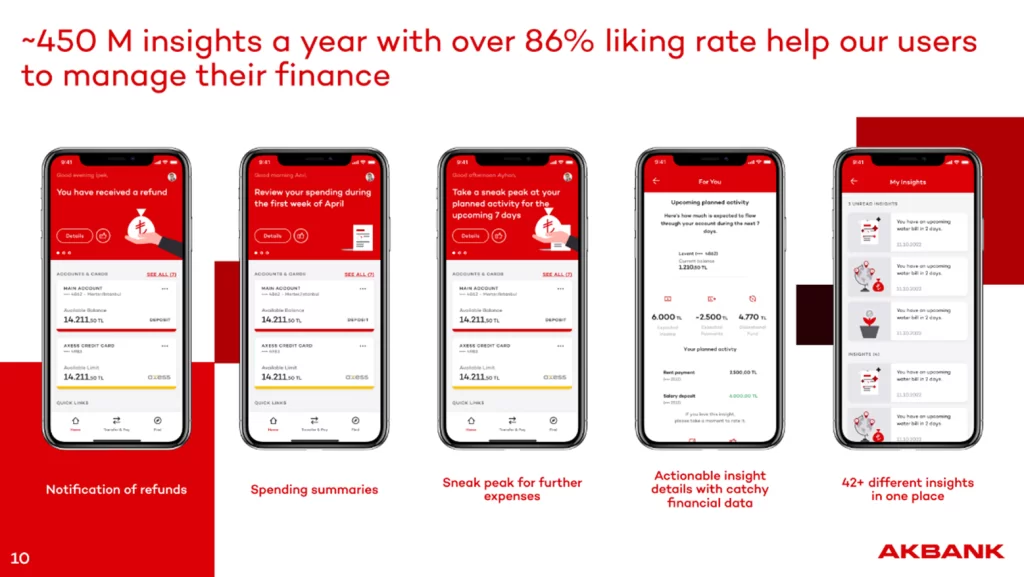

Over time, Banking IQ grew, and during her talk at Money 20/20, Burcu mentioned its expansion to 42 distinct insights. These encompass aspects like budgeting, cash management, payment alerts, stock updates, and highlight both regular and atypical account charges.

By embedding Personetics’ AI technology into Akbank’s regular banking operations, customers accessing the mobile app are instantly met with these tailor-made insights.

Burcu Küçükünal

Akbank’s Digital, Design and Innovation SVP Burcu pointed out that,

“Our digital strategy with Personetics was to engage clients more frequently, where each and every engagement creates more value for the client. The engagement rate is a crucial strategic KPI for us. Now that we have seen positive results in the engagement rate, we plan to expand the number of personalized insights in the future.”

Collaboration Targets Customer Satisfaction

Burcu emphasized the overwhelming positive response to Banking IQ, citing a satisfaction score of 86% and an engagement level of 24%.

Some of the customers providing feedback in performance surveys mentioned the insights being easy to understand, practical, and fast. Some highlighted the minute yet criticial information that the system surfaces, while one customer stated that Banking IQ “is like having a personal accountant.”

Collaborating with Personetics, Akbank has garnered impressive outcomes in better catering to their banking clientele, with aspirations to continually improve their offerings.

Akbank’s Future Roadmap for Banking IQ

Looking forward, Akbank’s objectives with Personetics span introducing their take on Open Banking, offering customers an integrated view of their financial interactions across different institutions. This unified perspective will furnish clients with a comprehensive financial behavior analysis, presenting competitive alternatives, boosting engagement, and aiding them in financial decision-making.

The bank also aims to expand their personalized insights, intending to have 65 by year’s end. With the aid of Personetics’ Engagement Builder, Akbank can swiftly fashion these custom insights.

Lastly, they plan to develop more insights, drawing from the feedback and desires of Akbank’s customer base, aiming to further elevate client interactions.

Featured image credit: Burcu Küçükünal, Digital, Design and Innovation SVP, Akbank

No Comments so far

Jump into a conversationNo Comments Yet!

You can be the one to start a conversation.