In Qatar, banking institutions are at the forefront of fintech innovation as they embrace new technologies, innovative payments methods and novel business models to keep up with changing customers’ preferences, a new report by global consultancy says.

The 2023 Qatar Banking Sector report, released on October 08, provides insights and predictions for the future of the banking sector in Qatar, discussing key financial indicators, emphasizing the importance of digital transformation and sustainability measures in the sector, and outlining the different initiatives launched by the government to foster a strong fintech ecosystem.

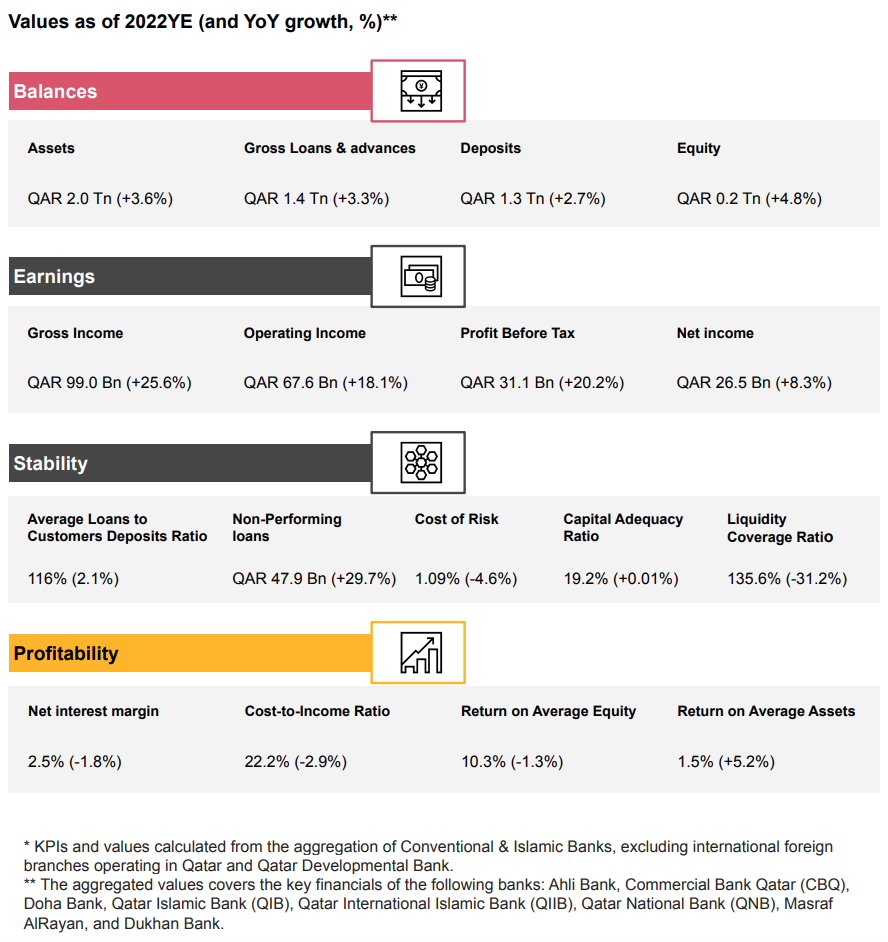

The report states that despite facing some challenges, the Qatari banking sector is posting positive financial performance with growth in balance sheet, financing portfolio as well as operating income and profit.

In 2022, assets increased by 3.6%, reflecting expansion in the banks’ overall holdings, while gross loans and advances grew by 3.3%, indicating increased lending activities. Deposits rose by 2.7%, showcasing continued inflow of customer funds.

Overall, gross income surged by 25.6% amid rapidly rising interest rates, while operating income and profit before tax increased by 18.1% and 20.2% respectively, showcasing improved operational efficiency.

Qatari banks key financial performance highlights, Source: PwC Middle East, Oct 2023

The sector’s solid financial performance comes at a time when Qatari banks are upping their core banking activities with initiatives aimed at digital innovation, data infrastructure establishment, and sustainability practices.

Embracing technology, new models and ESG standards

In Qatar, banks are proactively developing new digital products, the report says, embracing digital technologies and establishing strategic partnerships with fintech companies to strengthen their positions.

In particular, the report notes that banks are introducing contactless, personalized, and diverse digital payment options to align with customers’ changing demands. Incumbents are also embracing open banking in a bid to enhance banking experience to their customers, as well as partners and emerging fintech players.

One notable partnership that highlights the commitment to improving customer experience is the collaboration between the Qatar National Bank (QNB) and blockchain startup Ripple, a partnership that culminated in the launch of a remittance service that delivers near real-time international transactions.

The banking sector in Qatar is also undergoing a notable transformation in environmental, social and governance (ESG) practices where incumbents are working to meet international expectations by developing comprehensive ESG policies, risk management frameworks, and annual reports, the report says.

Qatar Islamic Bank (QIB) is one particular player that has been committed to sustainability. In 2021, the bank made ESG an integral part of its corporate strategy, introducing a plan intended to positioning it as a recognized Qatar market leader in Sharia-compliant sustainable finance. The plan encompasses several key areas: maintaining sustainable financial performance, effective risk management and governance, minimizing environmental impact, fostering financial inclusion, promoting accessibility, and driving digital innovation.

Meanwhile, Dukhan Bank, one of Qatar’s largest retail banks, signed a partnership with the Gulf Organisation for Research and Development (GORD) in December 2022 to launch a Shariah-compliant green and sustainable real-estate finance program for project owners and developers.

A changing landscape

Qatar’s evolving banking landscape comes amid a rise of fintech development, increased involvement of non-financial service providers in the banking industry and commitment from the government to fostering the growth of the domestic Qatari fintech sector.

These efforts have taken the form of a national task force dedicated the fintech sector; the Qatar Fintech Hub (QFTH), which is managed by the Qatar Development Bank (QDB) under the Qatar Central Bank (QCB); the fintech sandbox launched in 2022; and the National Vision 2030, a development plan aimed at “transforming Qatar into an advanced society capable of achieving sustainable development” by 2030 and which priorities economic diversification; among others.

In March, the QCB released the fintech strategy for 2023, outlining its ambition to create a leading and attractive fintech market infrastructure, and develop a comprehensive ecosystem for fintech companies to growth, maturity and scalability.

Under the plan, the central bank said it will develop regulations covering digital banking, open banking and crowdfunding, among emerging technologies and business models.

Most recently, the Qatar Financial Centre (QFC), a leading onshore financial and business center in the country, unveiled the QFC Digital Assets Lab. Powered by the QCB, the lab aims to foster open innovation in the digital assets and distributed ledger technology (DLT) domains in Qatar through proof-of-concept and proof-of-value.

The central bank has also been granting licenses to fintech companies, permitting them to provide digital payment services in Qatar. So far, ten companies have been licensed under the Payment Services Regulations, a framework that came into force in September 2021.

New rules were issued in August 2023 to govern the nascent and yet fast-growing buy now, pay later (BNPL) space. The Buy Now Pay Later (BNPL) Regulations, a set of regulations and a licensing framework for companies wishing to offer BNPL arrangements in Qatar, require BNPL providers to maintain a minimum capital of QAR 5 million (US$1.4 million) as initial paid-up capital or 15% of the outstanding loans, whichever is higher.

They must calculate the outstanding loan amount as per the average daily balance for the last 90 days, and must undertake the complete credit risk of the provided facility.

BNPL providers are prohibited to offer or lend cash to their customers, and must ensure that consumers do not exceed the maximum credit threshold of QAR 25,000 (US$7,000) from all BNPL providers at any point in time.

Featured image credit: edited from Unsplash

No Comments so far

Jump into a conversationNo Comments Yet!

You can be the one to start a conversation.