Banking solutions that go beyond traditional services are going to be an “important battlefield” for banking in the UAE.

A new report by Arthur D. Little and M2P analysed responses from about 2,000 UAE retail bank customers to determine how consumer forces are changing banking in the UAE. The report suggested that UAE banks are now going “beyond banking,” tapping into growth territories beyond financial services.

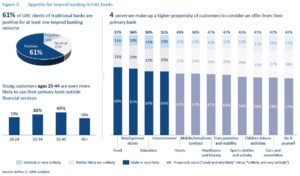

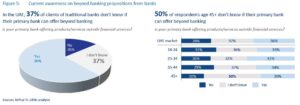

It found that 61% of banking customers were willing to use a beyond banking proposition by their primary bank. The most attractive opportunities in this space included entertainment, education, retail, and food.

Meanwhile, developments in B2C and B2B ecommerce, open banking, and data protection laws, are also driving new trends in this space, the report said.

“As financial and lifestyle services continue to converge, and financial products (payments, lending, insurance, etc.) are further embedded into customer lifestyle journeys, enriching existing banking offerings with lifestyle services can ensure that incumbent banks build deeper and more relevant relationships with their customers.

To facilitate this, banks must adopt multiple strategies simultaneously — building, orchestrating, and/or partnering with partners in the evolving ecosystem,”

Arjun Vir Singh, Head of Financial Services – MENA at Arthur D. Little, said.

Digital services put pressure on UAE banks to change

Low return rates and regulatory changes have demanded that UAE banks rethink their survival and growth strategies. This is further amplified by new players in the financial services arena, such as fintechs companies, neobanks, telecom providers, retailers, and consumer tech players.

Elsewhere, consolidation and integration within the ecommerce and financial industries, driven by local innovators, superapps and the COVID-19 pandemic, is leading to new consumer expectations from banking in the UAE. Citing research, the report noted that ecommerce has grown steadily in the Emirati nation, growing 53% year-on-year in volume during 2020.

Specific to banks, digital channels have clearly taken the lead over branch interactions, the report said. In the GCC, 89% of consumers are more likely to choose digital banking over branch banking, the report cited.

Consumers expect institutions to go beyond banking

Banks have traditionally been institutions of trust and loyalty. This has changed dramatically in recent times. The report found that 45% of traditional banking clients were willing to switch brands in the coming six months (nearly half of those were aged 25-34 years).

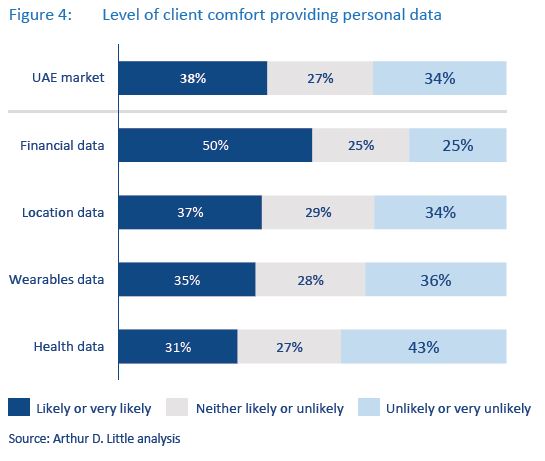

Personal data also comes into the play. While UAE banking customers have reservations about sharing their personal data, the study found that they would be willing to share data for a service that was appealing and brought value into their daily lives. In fact, 40% of respondents were likely to share personal data beyond banking services, the report found.

But banks are not the only ones they’re willing to turn to for beyond banking. Both retailers and tech companies were providers of choice amongst survey respondents who were not willing to consider their primary bank for an offering outside financial services. Telecom companies and insurers were also choices highlighted by this segment, as were exchange houses and digital wallet providers.

Featured image: Unsplash

No Comments so far

Jump into a conversationNo Comments Yet!

You can be the one to start a conversation.